Free Consultation

Complete your details below to reserve your FREE consultation.

Our team offers in person or remote online meetings.

This ensures we can service many more Australians & are NOT limited to supporting those located in the Newcastle region.

We have clients from all over the country that we continue to support.

So whether you are from Newcastle, Sydney, Brisbane or Canberra, our team can support you.

Australia’s cost of living crisis is not a global accident. It is the result of years of poor domestic policy decisions, runaway government spending and a refusal to address the real structural problems in our economy.

While households tighten their belts, politicians have fuelled inflation through excessive public spending, weak fiscal discipline and policies that have constrained housing supply, productivity and private sector growth. The result is higher interest rates, falling living standards and less money flowing through local businesses and communities.

This inflation is homegrown. Fixing it requires honesty, restraint and reform. Not excuses, spin or passing the blame to global events.

Australians deserve economic leadership that protects households, restores stability and creates sustainable growth. Until that happens, families will continue paying the price for Canberra’s mistakes.

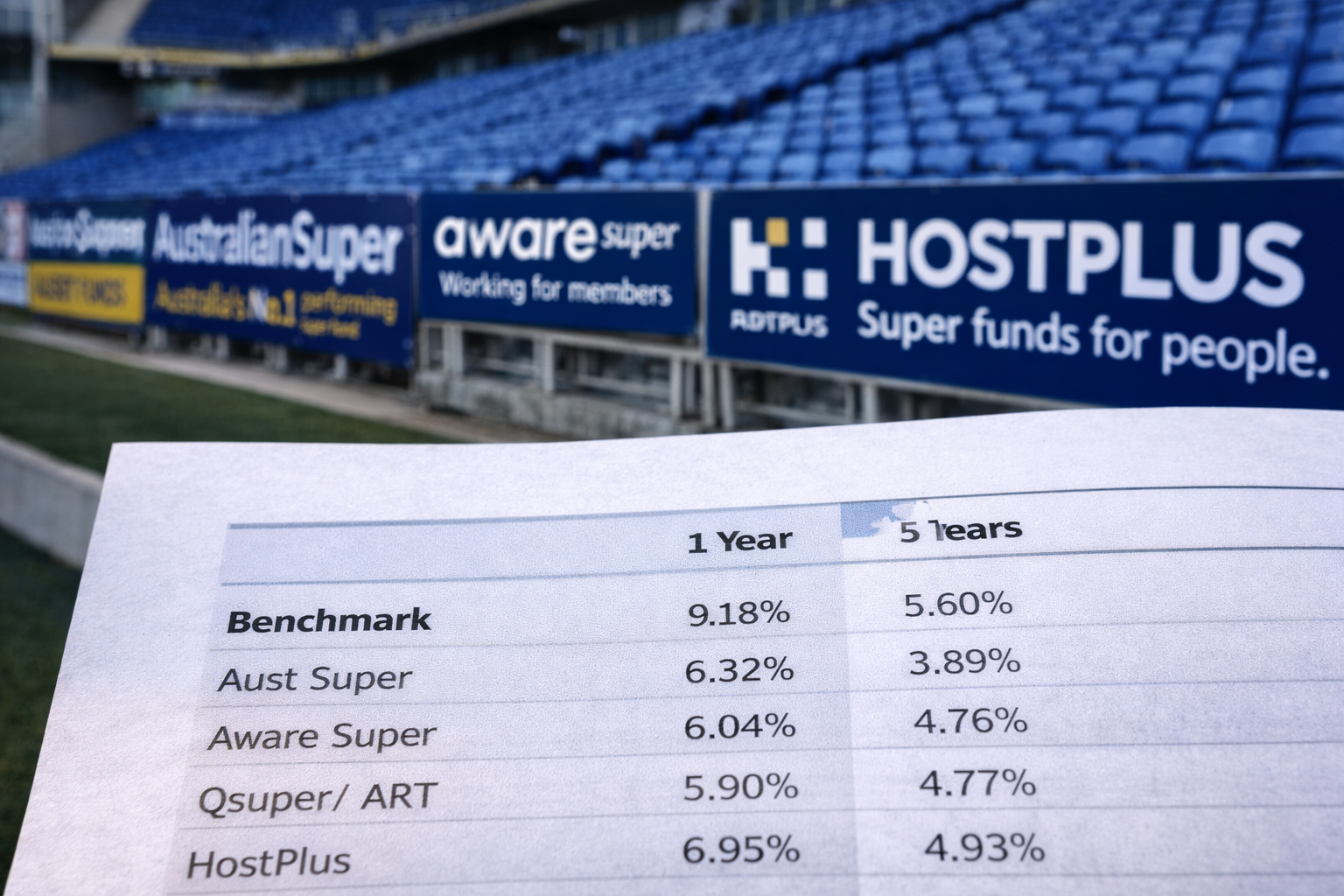

Industry super funds claim to be best performing, number one, and working only for members. But when you strip away marketing labels, awards, and inconsistent investment names, the data tells a different story. We compare balanced, growth, and high growth options on a like for like basis to see whether industry super funds are actually meeting the benchmarks they should, at a minimum, be achieving.

Global headlines can feel unsettling, especially when they involve politics, oil, and markets. Here is what has really happened in Venezuela, and what it actually means for your superannuation and long term investment strategy.

Should inheritance be included in your financial plan?

Many Australians quietly assume it will help fund retirement. The reality is far more uncertain. Here is how smart financial planning accounts for inheritance without relying on it.

The Bondi attack was confronting and traumatic for many Australians. For some, the impact will not fade quickly. This article explains how PTSD can affect daily life, work, income and financial security, and outlines the support and options available for those who need help navigating insurance, superannuation and Centrelink during recovery.

PTSD is not a weakness. It is an injury that can affect your ability to work, earn an income, and feel secure about the future.

For many Australians, navigating insurance claims, superannuation, tax rules, and Centrelink while dealing with trauma becomes overwhelming. This article explains the realities of PTSD related claims, the risks to watch out for, and the importance of having the right support during an already difficult time.

Medically retired Queensland Police Officers are facing a silent crisis. After years of service, many are left to battle QSuper, insurers, endless paperwork, and aggressive demands while dealing with PTSD and the fallout of medical retirement. This article exposes what really happens when the badge comes off, the emotional and financial toll, and how Newcastle Advisors helps officers protect their payout, reduce tax, and rebuild clarity and control.

Many Australians diagnosed with dust disease face declining health, limited work prospects and life changing workers compensation or TPD payouts. This article explains how to protect your settlement, reduce tax, qualify for disability support, create long term income and provide certainty for your family during medical retirement.

Matthew McCabe is a Newcastle financial adviser known for his empathy, strategic thinking and genuine care. He supports everyday Australians through major life changes, specialising in medically retired clients, men’s mental health, retirement planning and wealth strategy. Matt helps people gain clarity, confidence and a clear plan for their future.

Global markets experienced heightened volatility and a risk-off sentiment over the past week, driven by a confluence of factors including data uncertainty, inflation concerns, and anxiety surrounding key corporate earnings. While the NASDAQ and Russell 2000 showed significant volatility, other developed markets like Japan, Europe, and Australia also saw declines of around 5%. In contrast, emerging markets and global small companies outside the U U.S. demonstrated more resilience.

A primary concern for investors is the upcoming Nvidia earnings report, as AI valuations are now considered the top global tail risk, leading to pre-announcement jitters and a spike in the VIX. Compounding this, a U.S. government shutdown has created a data vacuum, delaying crucial economic reports and forcing the Federal Reserve to adopt a "wait and see" approach, making it difficult for policymakers and investors to accurately assess the market. Meanwhile, the Reserve Bank of Australia appears to be concluding its easing cycle due to the Australian economy's unexpected resilience, particularly in its housing market, which contrasts with weakening U.S. housing sentiment. This divergence in economic performance and central bank policies across regions, alongside shifts in commodity markets, points to uneven market performance and increased dispersion across sectors moving forward.