Are Industry Super Funds Really “Best Performing”? Or Are They Just Taking More Risk?

Are Industry Super Funds Really “Best Performing”? Or Are They Just Taking More Risk?

If you watch television, attend a sporting event, or walk past a stadium, you would be forgiven for thinking industry super funds are unbeatable.

Best performing.

Number one.

Working only for members.

Those claims are repeated constantly. But when you strip away the advertising budgets and compare the numbers properly, a very different story emerges.

We recently completed a like for like analysis across three clearly defined investment risk levels to cut through the noise.

Not the marketing.

Not the investment labels.

Not the awards super funds hand to each other.

Just the numbers.

The purpose was simple.

By stripping back the different investment names, classifications, and league table positioning, we wanted to understand whether industry super funds are actually delivering the minimum outcome they should be expected to achieve.

That is, are they meeting their relevant benchmarks once you compare genuinely comparable levels of risk?

What Does “Balanced” Actually Mean?

In plain English, a balanced investment option should be just that.

Balanced means:

50% defensive assets

50% growth orientated assets

Defensive assets include cash and fixed interest.

Growth assets include shares, property, and alternatives.

Think of it like a seesaw. If both sides carry the same weight, it is balanced.

The problem is that many industry super funds label their most marketed option as “balanced”, yet load it heavily with growth assets to improve short term performance and climb league tables.

Here is what the data shows.

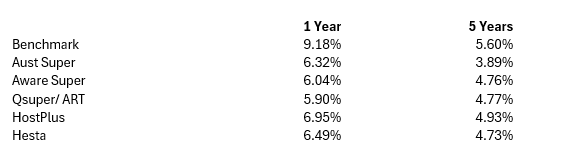

Balanced Investment Comparison

50% defensive, 50% growth

31-Dec-25, Benchmark: Balanced Composite Index

Despite the advertising, sponsorships, and constant claims of superiority, not one of these funds met the benchmark over one or five years.

And it gets worse.

The “Balanced” Options Are Not Balanced

When we looked under the hood, the so called balanced options were anything but balanced.

AustralianSuper balanced option holds approximately 82% in growth assets

Aware Super holds around 80%

Hostplus holds around 84%

Hesta holds around 75%

QSuper/ ART holds around 82%

That is not balance. That is growth.

The word “balanced” is being used because it is familiar, comforting, and widely compared in league tables. But in reality, these options carry far more risk than many members realise.

This is particularly concerning for people approaching retirement who believe they are invested conservatively, when in fact they are exposed to equity market volatility.

Why We Stripped Everything Back

To remove confusion, we compared true 50% growth options across funds. These options often have different names such as conservative, stable, or conservative balanced.

Different names, same risk profile.

This naming inconsistency makes it harder for everyday Australians to compare their super properly, despite claims that these funds are working in members’ best interests.

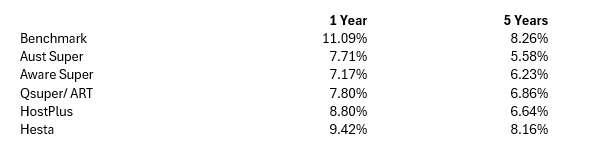

Growth Investment Options

30% defensive, 70% growth

31-Dec-25, Benchmark: Growth Composite Index

Once again, not a single option outperformed the benchmark over one or five years.

And yet, these options are marketed under a confusing mix of labels including balanced, conservative balanced, balanced growth, and conservative.

It raises an obvious question.

If the funds are confident in their performance, why make comparison so difficult?

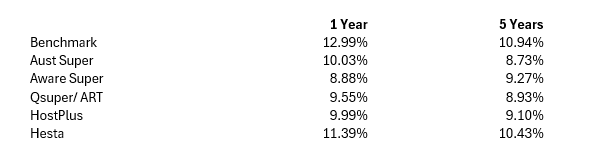

High Growth Investment Options

10% defensive, 90% growth

31-Dec-25, Benchmark: High Growth Composite Index

Even at the highest risk level, where members are exposed to significant market swings, none of the funds were able to beat the benchmark over one or five years.

That means members are taking more risk without being rewarded for it.

The Real Issue Is Not Performance Alone

This article is not about saying industry super funds are bad or that everyone should leave them.

The real issue is transparency.

When a fund claims it is best performing, number one, or superior, members deserve to know:

• How much risk is being taken

• Whether returns are beating appropriate benchmarks

• Whether labels match reality

• Whether performance comes from skill or simply higher exposure to growth assets

Too often, the answer is unclear.

What This Means for Your Super

If you are in a balanced option, there is a very real chance you are invested far more aggressively than you think.

If you are nearing retirement, this matters.

If you rely on your super for future income, this matters.

If market conditions change, this matters.

Super is not about chasing headlines or league tables.

It is about aligning risk, return, time horizon, and personal goals.

Our View

At Newcastle Advisors, we believe:

• Risk should be intentional, not hidden

• Benchmarks matter

• Labels should reflect reality

• Strategy should come before marketing

If your super fund is taking more risk, it should clearly explain why and deliver returns that justify it.

Anything less is not working solely in members’ best interests.

If you are unsure how your super is invested, what risk you are actually taking, or whether your fund’s performance stacks up against proper benchmarks, that is worth a conversation.

Because the biggest risk in super is not market volatility.

It is thinking you are protected when you are not.