How can you benefit from the Stage 3 tax cuts

How can you benefit from the Stage 3 tax cuts

As the 1 July deadline for the governments Stage 3 tax cuts approaches, many political commentators and organisations looking for headlines are screaming out for those earning less money / working less to have a far greater benefit from the legislated changes.

Rather than whinge and complain, whilst playing the victim card with things you cannot control, we wish to outline what the changes are and how you can adjust your financial plan to benefit from the changes.

There will be two key changes:

Merging tax brackets

The existing 32.5% & 37% tax brackets will be merged into a single 30% bracket for those earning between $45,001 and $120,000.

Raising the top tax bracket

The 45% tax bracket will start at $200,000 instead of $180,000.

Therefore, on face value most tax paying Australians will receive a small boost in their after tax income as a result of these Stage 3 tax cuts.

This is a very intelligent move by the government as it limits several tax planning strategies that the wealthy use to structure their income and wealth, with the benefits being significantly reduced with a larger 30% tax bracket.

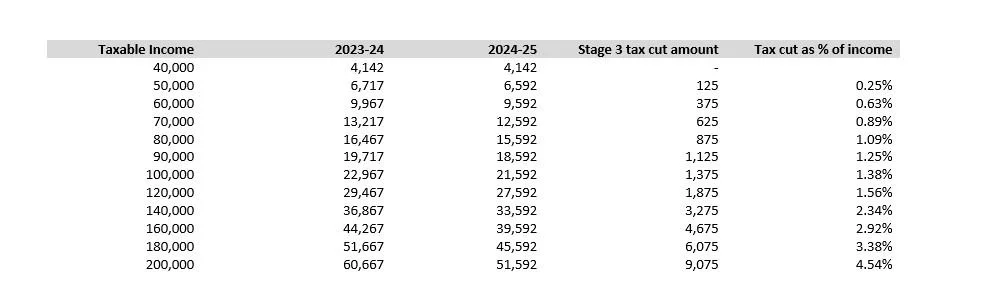

However, the following table illustrates the exact benefit you or your family household may receive from this tax cuts on 1 July 2024.

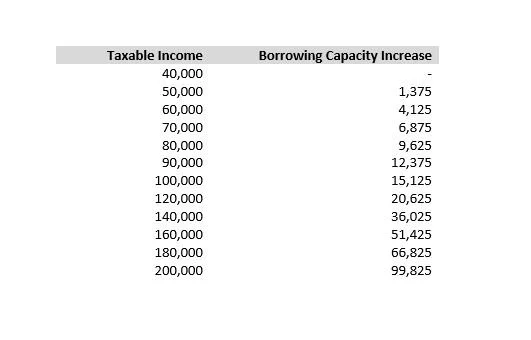

However, one of the factors that is often overlooked is the increase in your potential borrowing capacity.

Ones borrowing power could increase by $15,000 for someone with $100,000 annual income.

Many mortgage experts are exploring ways to support their clients and review their property strategy / financial plan, to ensure they are making the most of these tax cuts and the new borrowing capacity limits. As it is critical to understand that your borrowing capacity is based on your net income. Banks subtract your expenses and then lend to you based on your remaining/ surplus income. The higher your income, the larger the boost to your borrowing power will be.

The following table illustrates the potential increase in borrowing capacity:

So for a high income earning household, where both parties are earning $200,000, they would benefit from:

Tax cuts of $9,075 each

Plus increase of borrowing capacity of $99,825 each.

This would equate to a household tax saving of $18,000 plus the added benefit of increased borrowing capacity by $200,000.

* Edit *

The Government has announced proposed changes to the already legislated Stage 3 tax cuts commencing on 1 July 2024.

In a media release on Thursday 25th January 2024, the Government stated that these changes are “designed to provide bigger tax cuts for middle Australia to help with the cost of living, while making our tax system fairer.”

It is important to not that these changes are proposed only at this stage and have not yet been legislated.

What are the new stage 3 tax cut changes announced today?

The announced changes, effective from 1 July 2024 if legislated, will:

•reduce the current 19% tax rate to 16%

•reduce the current 32.5% tax rate to 30%

•increase the current threshold above which the 37% tax rate applies from $120,000 to $135,000

•increase the current threshold above which the 45% tax rate applies from $180,000 to $190,000

How would your tax cuts change?

Compared to the stage 3 tax cuts which are legislated to commence from 1 July 2024, the Government’s proposed tax changes from 1 July would provide a higher tax cut to individual taxpayers with taxable income of approximately $146,500 or less. Those with taxable income between $45,000 and $135,000 would receive an extra $804 in tax cuts under the proposal.

Taxpayers with taxable income of more than approximately $146,500 would receive a lower tax cut from 1 July under the prosed changes. The maximum tax cut would also be approximately halved (from $9,075 to $4,529) under the proposal, with the maximum tax cut applying where taxable income is $190,000 or more.

In light of these impending changes, it would be prudent to get your financial advisor, accountant and mortgage broker together to review your financial plan, investment property strategy and start planning your financial future under the new legislated tax rates.