RBA Cuts Rates: What It Means for Homeowners, Retirees, and the Housing Market

📉 RBA Cuts Rates: What It Means for Homeowners, Retirees, and the Housing Market

The Reserve Bank of Australia has just dropped the cash rate by 0.25% this afternoon (Tuesday 20th May, 2025).

That brings the official cash rate to 3.85%, marking the second cut this year — and there’s more expected.

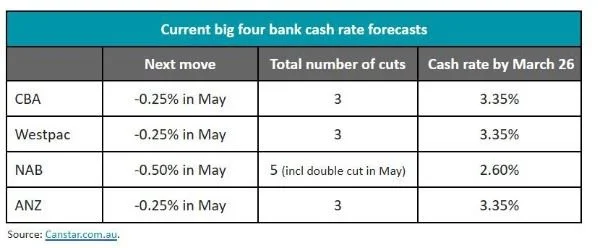

All four big banks are forecasting further drops, with NAB even tipping a double cut in May, taking the rate down to 3.60%.

Here’s what it means for you — whether you’re paying off a mortgage, planning your retirement, or just trying to make sense of what’s next.

🏡 Mortgage Holders: Time to Get Proactive

If your bank passes on the full 0.25% rate cut (as many will), here’s the impact:

And that’s just from one cut. With most big banks forecasting three cuts in total, the savings could triple — unless you sit back and do nothing.

Lender Competition Is Hot

Since the start of April, 15 lenders have already cut variable rates — and that’s before today’s RBA decision.

Some are offering variable rates under 5.70%, with fixed rates starting with a ‘4’ for the first time in years.

If you're sitting on a variable loan above 6%, you might be donating hundreds of dollars a month to your lender.

🔍 Time to Shop Around

With more than 30 lenders expected to offer rates under 5.50%, don’t wait.

Call your bank. Compare offers. Or get in touch and we can refer you to our one of the brokers on our preferred partners panel, to review your options together.

👴 For Retirees: What Falling Rates Really Mean

A rate cut may sound like good news for borrowers — but for retirees relying on cash or term deposits, it’s the opposite.

Income from cash savings will fall. Less interest = lower returns on your nest egg.

You might need to rethink your income strategy, especially if you’ve been playing it safe with high-interest accounts.

💡 Time to Hunt for Yield

With term deposit rates likely to drop below 4%, retirees may need to consider:

Income-focused investments (think: quality dividend stocks or income producing funds)

An updated strategy that balances safety with sustainable yield

A conversation about how to protect your capital while still getting paid

📈 House Prices Set to Climb

Economists are warning that rate cuts may push property prices even higher.

Many financial models indicate that a 1% rate cut = a 6% lift in house prices within a year.

If three more rate cuts land by March 2026, price jumps could look like this:

Sydney: +$87,600 → New median: $1,547,600

Brisbane: +$55,200 → New median: $975,200

Adelaide: +$49,620 → New median: $876,620

In other words: if you’re thinking about upgrading, downsizing, or investing — timing matters.

🧠 The Bottom Line

This isn’t just another rate cut — it’s a signal.

The RBA is now in easing mode.

Lenders are getting competitive. Prices are moving.

Whether you’re paying off a mortgage, planning retirement income, or trying to time the market, the smartest thing you can do right now is review your position.

📞 Let’s chat.

A 15-minute check-in could save you thousands or protect your future income.