PPS Mutual Accredited Adviser

Our Newcastle Advisors principal financial planner, Matthew McCabe has been accredited to provide advice with PPS Mutual. Matthew becomes only the second accredited financial planner in the Newcastle region.

PPS Mutual have designed the PPS Mutual Professionals Choice product to provide Australian professionals with a unique and tailor-made personal insurance offering.

Because only a defined group of professions can join PPS Mutual, we have designed the insurance benefits precisely to meet the protection needs of our professional Members. All the benefits of our Professionals Choice product are comparable with the very best out there.

What is a mutual insurer?

A mutual insurance company is owned by the Policyholders and existrs for their benefit.

By taking out an insurance policy with PPS Mutual, you become a Member and share in its profits.

This is different to a listed insurance company, which has two masters, shareholders and customers. The shareholders almost always come first and claim the profits of the company.

Back in the 1960s, 70s, and 80s, names like National Mutual, Mercantile Mutual, Australian Mutual Provident (AMP), Mutual Life & Citizens (MLC) dominated city skylines. During the 1990s AMP and National Mutual de-mutualised and became publicly listed companies and the big banks bought up the other mutuals.

Now, the big banks and their shareholders largely own the Australian life insurance market.

As a result, many things have changed.

Policyholders have experienced significant price increases in recent years and in some cases, life insurance claims have been unfairly knocked back (or in one of our client situations, we have a client that has a disability with PTSD - both medical PTSD, work PTSD, trauma PTSD, which the insurance company requires the client to go to the workplace, the hospital to get 2 of the 72 pages of the claim form completed. Which is one way big super funds and insurers are delaying claims by making it too difficult with people with disabilities, mental illnesses and/or PTSD).

The entry of PPS Mutual provides a real solution as the mutual structure means they are not subject to shifts in the share market or the financial pressures of listed companies, but they can align their interests to that of their members/ policyholders.

PPS Mutual offer a niche insurance product to a select group of people, this enables PPS to secure favourable terms with their re-insurer, which in turn enables them to keep premiums competitive without the large increases you are seeing from some of their competitors at the moment.

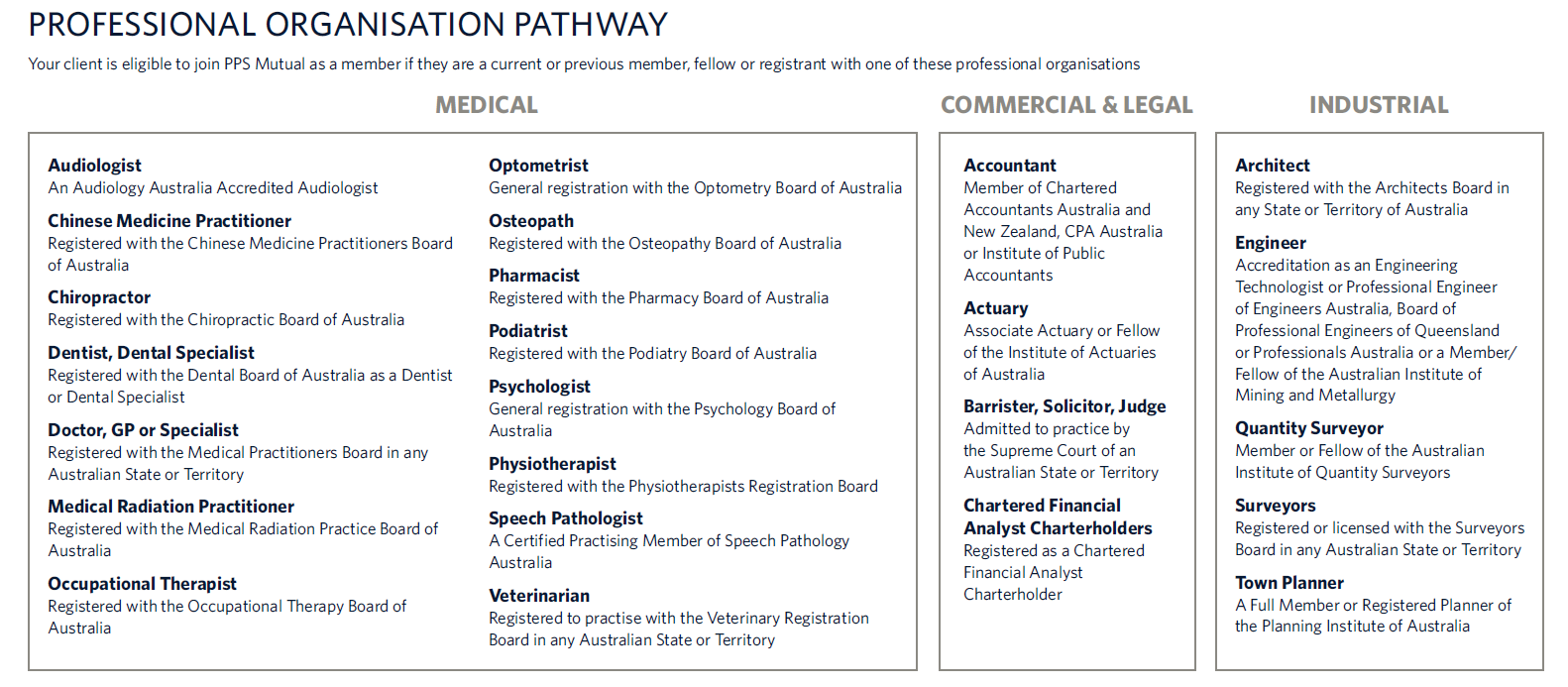

The main professional occupations that PPS Mutual provide insurance protection for include; chiropractors, dentists, doctors, GP, specialist doctors, medical radiation practitioner, occupational therapist, optometrist, osteopath, pharmacist, podiatrist, psychologist, physiotherapist, speech pathologist, veterinarian, accountants, actuary, barristers, solicitors, judges, architect, engineer, and surveyors to name a few.

Therefore, if you are seeking advice, and are covered in one of the abovementioned occupations, seek advice from an acceredited PPS Mutual financial adviser.

Newcastle Advisors are be able to support you with the PPS Mutual offering, comparing this to the other providers in the market including, AIA, TAL, NEOS, OnePath, Zurich, Encompass, MLC, and Metlife, to ensure you have the best policy for your specific circumstances and financial plan.

Contact our financial advisers directly on 02 4942 7495 or via email info@newcastleadvisor.com to learn more.